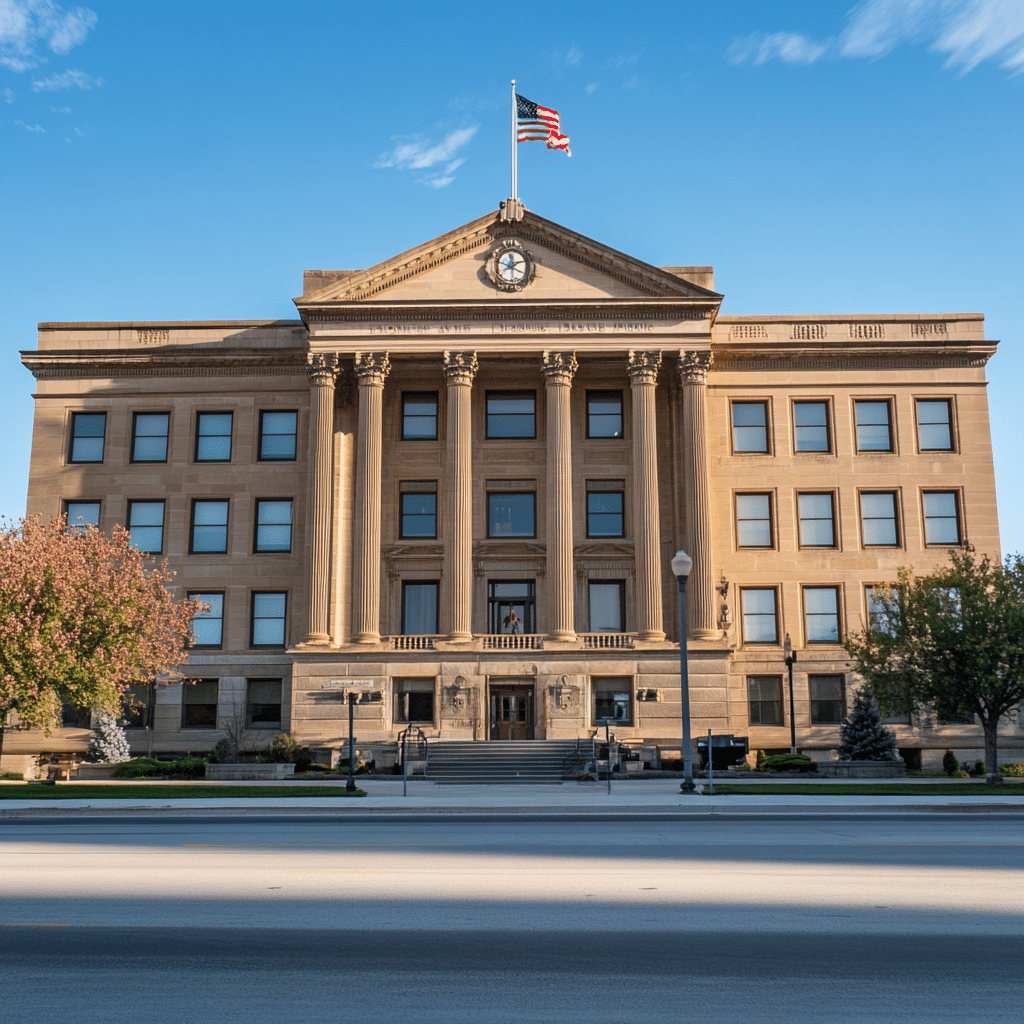

In 2024, the Iowa Department of Revenue has launched a series of transformative changes that not only reshape how taxation is approached but also redefine taxpayer interaction in the state. With a keen eye on incorporating technology and addressing community needs, these changes significantly affect both individual taxpayers and businesses across Iowa. By focusing on transparency, innovation, and inclusivity, the Iowa Department of Revenue has set a new standard for effective public service within its jurisdiction.

Transformative Changes by the Iowa Department of Revenue in 2024

The Iowa Department of Revenue has made leaps in modernizing its operation through several key reforms this year.

Comparative Analysis: Iowa Department of Revenue vs. Oakland Police Department and Sacramento Municipal Utility District

To get a better grasp of the initiatives led by the Iowa Department of Revenue, it’s worthwhile to see how they stack up against other public entities such as the Oakland Police Department and Sacramento Municipal Utility District.

Implications of Transformative Taxation Strategies in Iowa

The progressive changes brought forth by the Iowa Department of Revenue extend beyond taxation, making waves throughout the state’s economy and policy-making landscape.

Innovative Wrap-Up

Through thoughtful integration of technology, community involvement, and financial incentives for sustainable practices, the Iowa Department of Revenue is reinventing what taxation means in 2024. As it leads with innovation, Iowa not only transforms its own taxation landscape but also inspires other states to follow suit. This fresh approach holds promise for a more inclusive and forward-thinking taxation system that aligns with the needs of residents and businesses alike. By focusing on these pivotal changes, the Iowa Department of Revenue is not just reacting to current demands but is actively shaping the future of taxation – one tailored policy at a time.

With initiatives echoing those seen in the Oakland Police Department and Sacramento Municipal Utility District, the Iowa Department of Revenue sets an example for integrating public service and community engagement. As we move forward, it’s clear that the transformation within Iowa’s taxation system offers a glimpse into what effective governance can and should look like in an increasingly complex world.

For more insights into modern governance and public service, explore related intriguing stories like Grantchester Season 9 or learn about Infanta Sofia Of Spain. Whether you’re interested in cultural phenomena like Kamakathalu or reminiscing about classic shows like Chico And The Man, there’s much to discover. As the tax landscape evolves, so too does our collective understanding of how to effectively engage with it.

Iowa Department of Revenue: Fun Facts and Insights

Behind the Scenes at the Iowa Department of Revenue

Did you know that the Iowa Department of Revenue plays a pivotal role in shaping tax policy across the state? Beyond just collecting taxes, they’re crucial in implementing laws that affect everything from public education to infrastructure. This governmental body ensures that the funds generated contribute significantly to community resources, much like how the process of breaking in works for new regulations and systems, proving that adaptation is key in state governance.

Speaking of adaptation, Iowa’s tax system has evolved over the years to address the changing needs of its citizens. For instance, they’ve introduced various tax credits aimed at relieving the burden on families and small businesses. This kind of thoughtful adjustment is key, as seen in other contexts like Soapland, where understanding local needs can lead to meaningful impacts. Whether it’s optimizing revenue systems or evaluating tax structures, the Iowa Department of Revenue continuously seeks innovative ways to serve Iowans better.

Trivia That’s Worth a Shout-Out

Curious about how the Iowa Department of Revenue operates in comparison to other regions? One fun fact is that Iowa’s average income tax rate is on the higher end compared to many states, which means when citizens pay their taxes, the revenue can significantly impact local services. This is much like currency exchanges, where understanding the value of something as specific as 5000 Pesos To Usd can be pivotal. It underlines the importance of knowing what goes into the community pot.

Moreover, while most people think taxes are all about numbers, they often ignore the people behind those figures. Take Enrica Cenzatti, for instance; her journey from conservatory student to managing real estate showcases how creative thinking can flourish in any arena, even tax management. Just like The Wild robot reviews can attract a diverse audience, the Iowa Department of Revenue aims to connect with residents in a transparent manner, fundamentally bridging the gap between taxpayers and tax collectors. Engaging with residents helps illuminate why taxes matter and how they influence everyday life in Iowa—making the department a cornerstone of economic stability.

So, next time you’re reflecting on your taxes, remember the Iowa Department of Revenue isn’t just about the bottom line; it’s a dynamic player in shaping a brighter Iowa for all.