Automated teller machines (ATMs) have become essential in our daily banking routines, providing unparalleled access to cash and banking services. However, the latest automated teller machine news has shaken users to their core with reports of shocking security breaches. These vulnerabilities not only jeopardize personal finances but also highlight a growing concern about the safety of our banking systems. In this article, we delve deep into the ramifications of these breaches, unveil common patterns, and share insights on safeguarding your financial information.

7 Disturbing Examples of ATM Security Breaches

In recent months, numerous incidents have surfaced where fraudsters have installed sneaky skimming devices on ATMs situated at drive-through car washes. For example, in New York and Los Angeles, unsuspecting customers unknowingly used these machines while their card details were quietly being siphoned off. This kind of attack blends the mundane with the malicious, catching many users off guard.

An alarming investigation unveiled that certain stash box ATMs, which allow users to safely deposit cash for later retrieval, have been systematically hacked. Users have reported unauthorized withdrawals, raising serious concerns about both the physical security and digital protections in place at banks. This breach is particularly worrying, as these ATMs promise a level of security that users trust.

Another dangerous trend involves deceitful phishing scams that have emerged in connection with ATM operations. Many users have recounted receiving dubious emails that urge them to verify their account details after utilizing an ATM. These scams exploit users’ trust in familiar banking practices, leading to unauthorized access to sensitive personal information. Users must remain vigilant to avoid falling prey to these tactics.

Many notable banks, including Bank of America and Wells Fargo, have unfortunately become victims of substantial data breaches. Recent reports in automated teller machine news have disclosed how attackers managed to steal millions of customer records using sophisticated malware that compromised ATM operations. The scale of these breaches leaves countless users exposed.

Reports are pouring in about skimming incidents targeting ATMs located at Stop and Shop stores. Shoppers said they noticed unusual activity in their accounts almost immediately after using these machines. The seeming complacency in maintaining security measures, like the ones found at the Stop and Shop Pharmacy, raises a fundamental question about the effectiveness of existing security protocols.

While less common, insider threats pose a serious risk to ATM security. Recent reports have implicated a few bank employees who allegedly conspired with criminals to glean user data from ATMs. These troubling revelations often remain hidden until customers raise alarms about unauthorized transactions, showcasing a severe breach of trust.

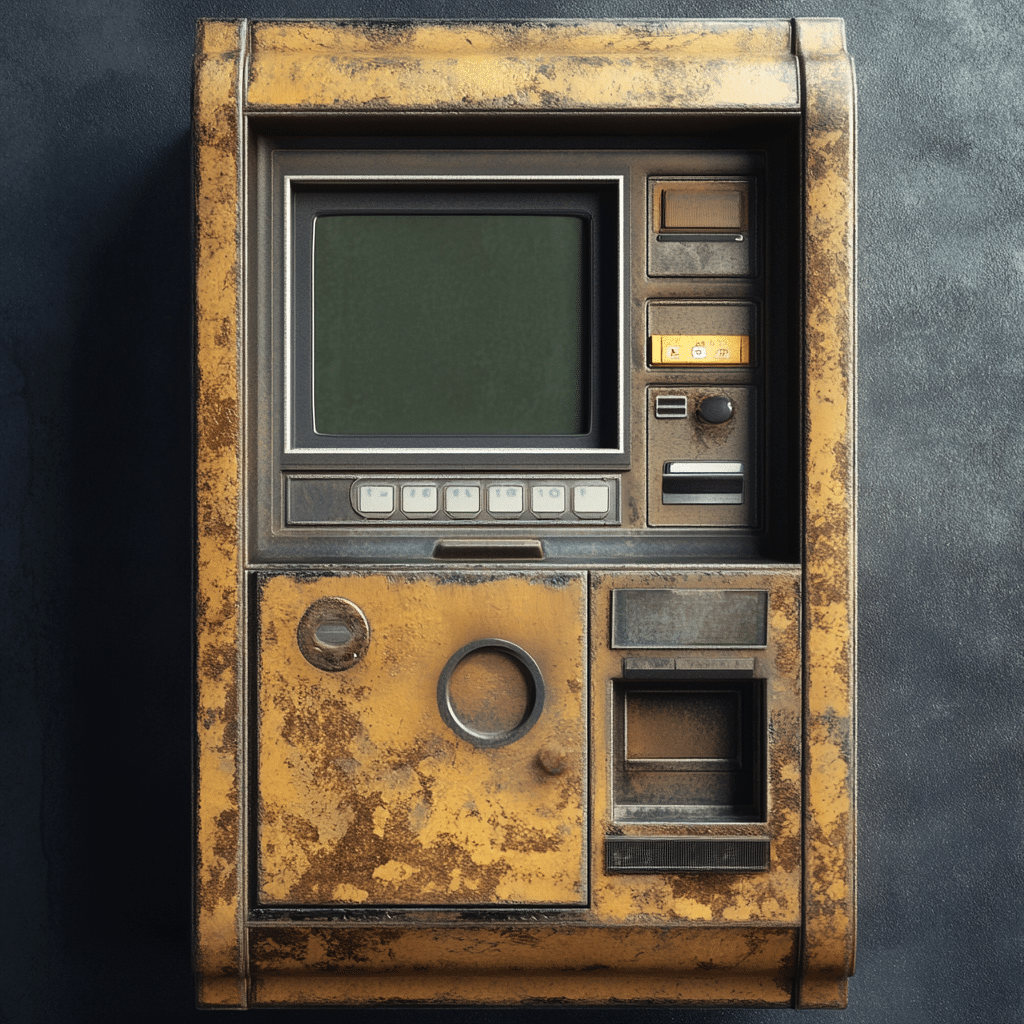

Many users may not realize how lacking maintenance can transform an ATM into a security risk. Machines that don’t get regular updates may harbor vulnerabilities hackers can exploit, as seen in several cases where outdated software led to unauthorized access. Regular maintenance checks are crucial to safeguarding our finances.

Safety Tips for ATM Users

With these alarming security flaws now apparent, it’s essential for users to adopt proactive safety measures. Here are some tips to help keep your finances secure:

The Future of ATM Security: What Lies Ahead?

As technology leaps forward, so do the tactics employed by criminals. Banks are gradually adopting advanced security measures, including biometric authentication and enhanced transaction monitoring systems. Alongside these innovations, educating users remains a significant factor in combatting ATM fraud.

Organizations are also advocating for regulatory standards that mandate improved security features on ATMs. This includes encrypted communication channels and upgrade alerts that can notify users of suspicious activities. Such advancements could go a long way in restoring public trust in automated teller machines.

Final Thoughts on ATM Security

The recent automated teller machine news highlights the growing urgency for awareness and vigilance among users. In a climate where convenience often overshadows caution, it’s vital to recognize that one moment of negligence could lead to serious financial loss. Technological advancements must work hand in hand with involved users to ensure that ATMs remain a secure and reliable resource in our everyday lives.

Emphasizing thorough monitoring of finances, regular communication with banks, and proactive engagement with ATM security measures can significantly mitigate risks. After all, in a time of technological advancement, staying informed and alert could be your best defense against fraud and theft. If you think about it, keeping your wits about you today could save a world of trouble tomorrow!

Automated Teller Machine News: Unpacking Security Hiccups and More

The Rise and Role of ATMs

Did you know that the first automated teller machine (ATM) made its debut in 1967? The machine was installed in London by Barclays Bank and allowed customers to withdraw cash without visiting a teller. Over the years, ATMs have evolved, not just as cash dispensers but also as multifunctional devices offering services like account balance inquiries and even cash deposits. It’s interesting to think about how this innovation changed practices in banking, creating a shift in how people access their money. And speaking of access, have you ever wondered about some fun facts surrounding celebrity trends? For example, if you search for exciting content, you might stumble across some surprises like Megan fox Nudes, but it’s always good to focus on the essential tech discussions at hand.

Security Breach and Its Impact

Amidst the convenience of ATMs, security breaches have cast a shadow over their reliability. Recently, reports surfaced regarding a massive data breach affecting numerous users. Experts emphasize the need for enhanced security measures to prevent unauthorized access and fraudulent activities. Such vulnerabilities can expose sensitive information swiftly, escalating fears of identity theft. While we’re talking vulnerabilities, did you know that some myths surround the afterlife? For instance, When a dragonfly Visits You after death is a popular belief that evokes curiosity—just like how banking technology stirs strong opinions among users today.

Fun Facts and Trivia

Now, let’s sprinkle in some intriguing trivia. Did you know that ATMs dispense about $300 billion in cash each year? That’s a whole lot of moolah being circulated! Many folks rely on these machines in times of need, much like how travelers check for asheville airport Flights Canceled when planning trips. In terms of interaction with technology, it’s fascinating to see how we’ve moved from simple cash pulls to complex transactions on our smartphones. And while you’re contemplating the significance of shifts in tech, consider this: Drones once seemed like something out of a sci-fi flick, akin to a storyline featuring Daemons from captivating tales.

In summary, the world of automated teller machine news reveals much about our culture and our reliance on technology. As the security landscape evolves, so must our awareness and usage of these machines. Just remember, while you’re tapping through the daily news, engaging with trivia like jason Schwartzman in online film discussions, keep an eye on updates about your favorite ATMs!