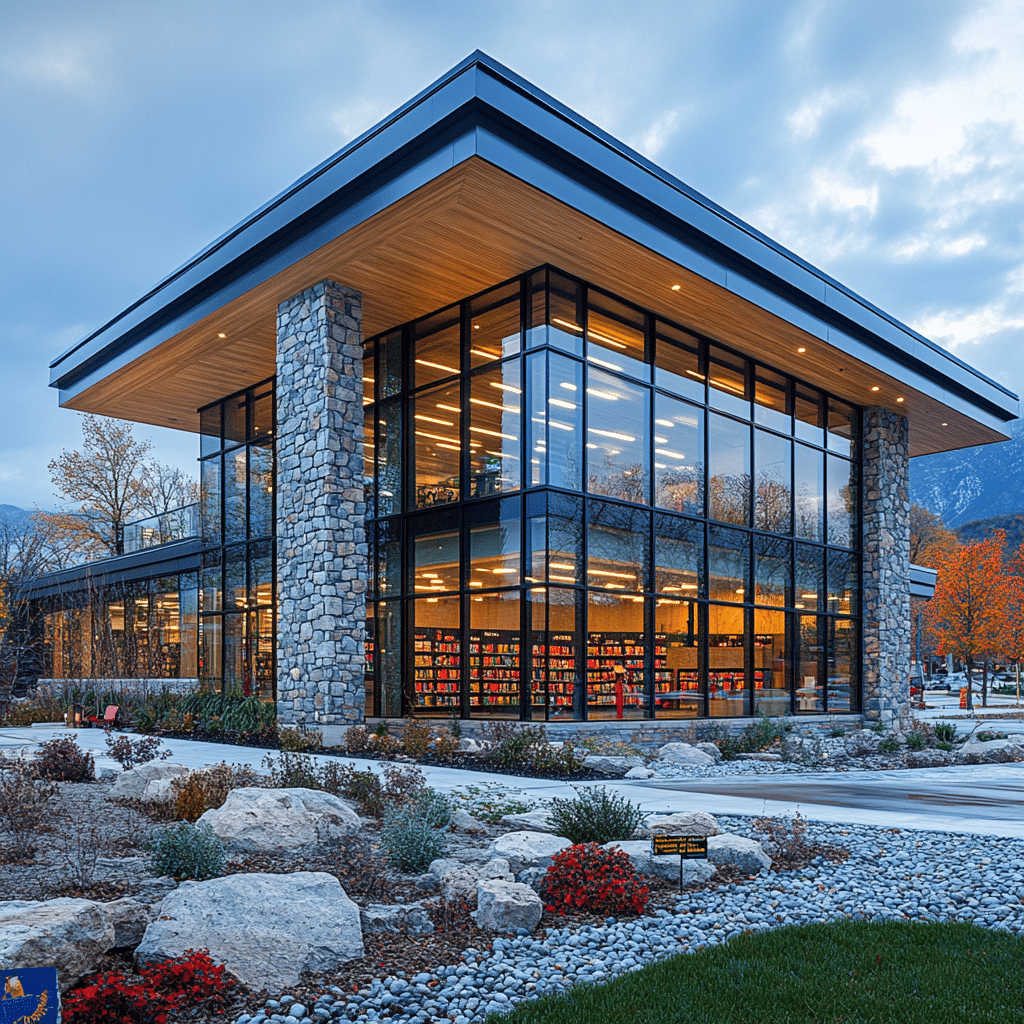

In the rapidly changing financial world, Clark County Credit Union (CCCU) stands tall, setting benchmarks for exceptional member services. This credit union has embraced the shifting tides of financial needs with open arms, adapting its services to offer members personalized banking experiences that resonate on a community level. With a strong focus on innovation and local unity, CCCU has built a membership base that values its cutting-edge services and community-driven initiatives, enhancing the overall quality of life in Clark County.

The Evolution of Clark County Credit Union’s Member Services

Over the past few years, the landscape of banking has drastically transformed. Traditional financial institutions have had to rethink their approaches, with credit unions like CCCU leading the charge toward member-centric solutions. This credit union is not just another financial institution; it’s a community partner, working tirelessly to meet the diverse needs of its members.

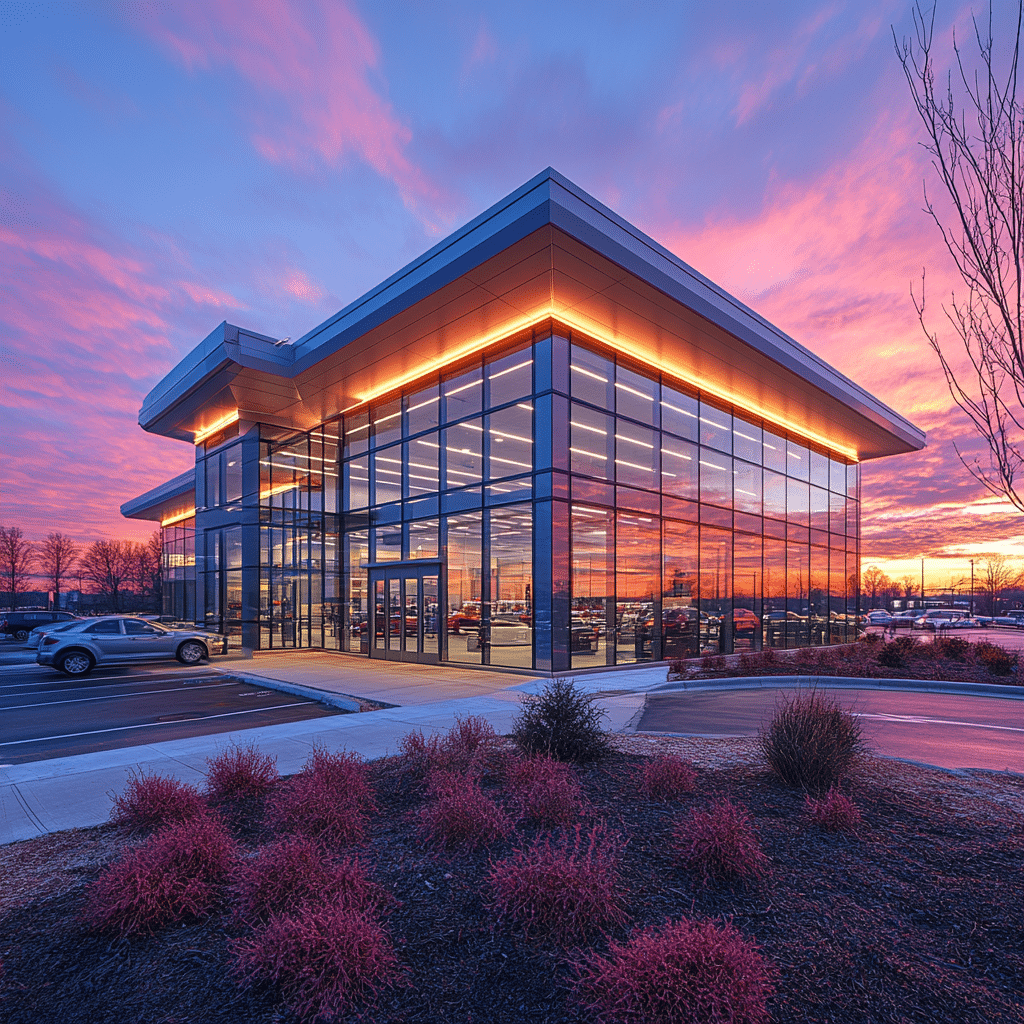

As banking technology evolves, Clark County Credit Union has positioned itself to leverage these advancements, continually improving its member services. In 2024, CCCU has rolled out several innovative features designed to enhance ease of access and financial empowerment, ensuring that every member feels valued and supported.

Top 7 Exceptional Member Services Offered by Clark County Credit Union

CCCU’s complimentary financial counseling sessions have proven invaluable, especially for members facing financial turbulence. With the help of certified financial planners, members receive personalized advice that encompasses their specific goals and enhances their budgeting capabilities.

Staying ahead of the curve, CCCU’s digital platform is loaded with advanced features. The recent introduction of an app tool powered by AI analyzes spending behaviors, providing real-time suggestions for savings, thereby boosting user engagement and satisfaction.

With a keen understanding of local needs, CCCU has tailored its loan offerings to support small businesses and home buyers efficiently. Their “Home for All” program, designed for first-time buyers, emphasizes community growth by providing down payment assistance and flexible repayment terms.

Recognizing the power of financial literacy, CCCU delivers monthly workshops on various crucial topics like retirement planning and investment strategies. These sessions often feature guest experts who enrich discussions, turning each workshop into a beneficial learning experience.

Encouraging engagement, the credit union has launched a member rewards program. By using their credit or debit cards for everyday expenses, members earn points that translate into discounts on loans or increased savings interest rates—an initiative that keeps members invested in CCCU’s services.

CCCU understands that effective communication is key. By introducing live chat options, extended service hours, and easy appointment scheduling through their app, the credit union has made professional support more accessible. The addition of AI chatbots for preliminary inquiries has also significantly cut down wait times.

With an unwavering commitment to inclusivity, Clark County Credit Union offers products that cater to all demographics. Whether it’s specialized accounts for students, seniors, or freelancers, CCCU ensures that everyone in Clark County has access to beneficial financial products.

Member Testimonials: The Heart of Clark County Credit Union’s Services

Nothing showcases the success of CCCU’s member initiatives quite like the voices of its members. Sarah Martinez, a local resident, enthusiastically shares, “Joining CCCU was a game-changer for me. Their workshops not only enhanced my budgeting skills but also made me feel like I had a reliable partner in managing my finances.”

Small business owner Tom Lindstrom echoes similar sentiments when discussing CCCU’s community-focused loans: “The support from CCCU was exactly what I needed to kickstart my business expansion. Their personalized approach made me feel valued—not just another customer in a long line.”

These heartfelt testimonials paint a vivid picture of the impact that Clark County Credit Union has on its community, reinforcing its reputation as a trusted financial ally.

Looking Forward: Clark County Credit Union’s Vision for the Future

The future looks bright for Clark County Credit Union as it continues to forge ahead in the financial sector. With the rise of automated solutions blended with a personal touch, CCCU is paving the way for the next generation of financial services. This forward-thinking credit union is exploring blockchain technology to ensure more secure transactions while actively participating in community projects that uplift local residents.

By consistently gathering feedback and adapting to members’ needs, CCCU is not just responding to the evolving financial landscape—but rather shaping it. As the credit union enhances its services and expands its reach, it becomes a benchmark for other financial institutions, proving that exceptional member services are not just advantageous but essential for fostering sustainable growth and community development.

As 2024 unfolds, CCCU’s vision remains clear. Their steadfast commitment to innovation and member satisfaction will undoubtedly continue to propel them forward, ensuring they remain a pillar of support for the people of Clark County and beyond. From personalized financial advice to rewarding community initiatives, Clark County Credit Union exemplifies what it means to be a true partner in finance.

In a world where financial institutions often prioritize profits, CCCU shines as a beacon of community spirit and dedication, a true testament to the power of responsive banking.

Clark County Credit Union: Fun Facts and Trivia

A Historical Snapshot

Did you know that the Clark County Credit Union (CCCU) has a rich history that dates back to 1951? Founded to cater to the financial needs of educators, its evolution reflects the community’s growth. Over the decades, it’s provided services to not just teachers but a vast array of residents, making it a cornerstone for many households in the region. Speaking of evolution, take a moment to ponder the ingenious Ted talk delivery Techniques that can transform your communication just as CCCU transforms member experiences through innovative financial products.

Member-Centric Approach

CCCU stands out not just for its services but also for its commitment to member satisfaction. They regularly host workshops that teach members about financial literacy, equipping them with practical tools. It’s a bit like applying Halloween makeup—getting the basics right will have you looking great in no time! Their approach underlines the importance of community trust, much like the fulfillment seen when discussing famous personalities like Sally Kellerman, whose legacy resonates with different audiences.

Unique Offerings

What really sets the Clark County Credit Union apart is its range of member services. From personal loans to mortgage solutions, it’s got something for everyone. They pride themselves on providing custom solutions that fit their members’ needs. You might even say they’re as versatile as Billy Zane Movies—there’s always something interesting on the horizon. As you explore your possibilities, a handy tool is a flight time calculator to plan that vacation you deserve once you’ve settled your finances.

In all, CCCU is dedicated to serving its members with an array of exceptional services, ensuring that no matter your needs, you’re taken care of. So, if you want to know more about your financial options, it’s worth delving deeper into what the Clark County Credit Union offers.