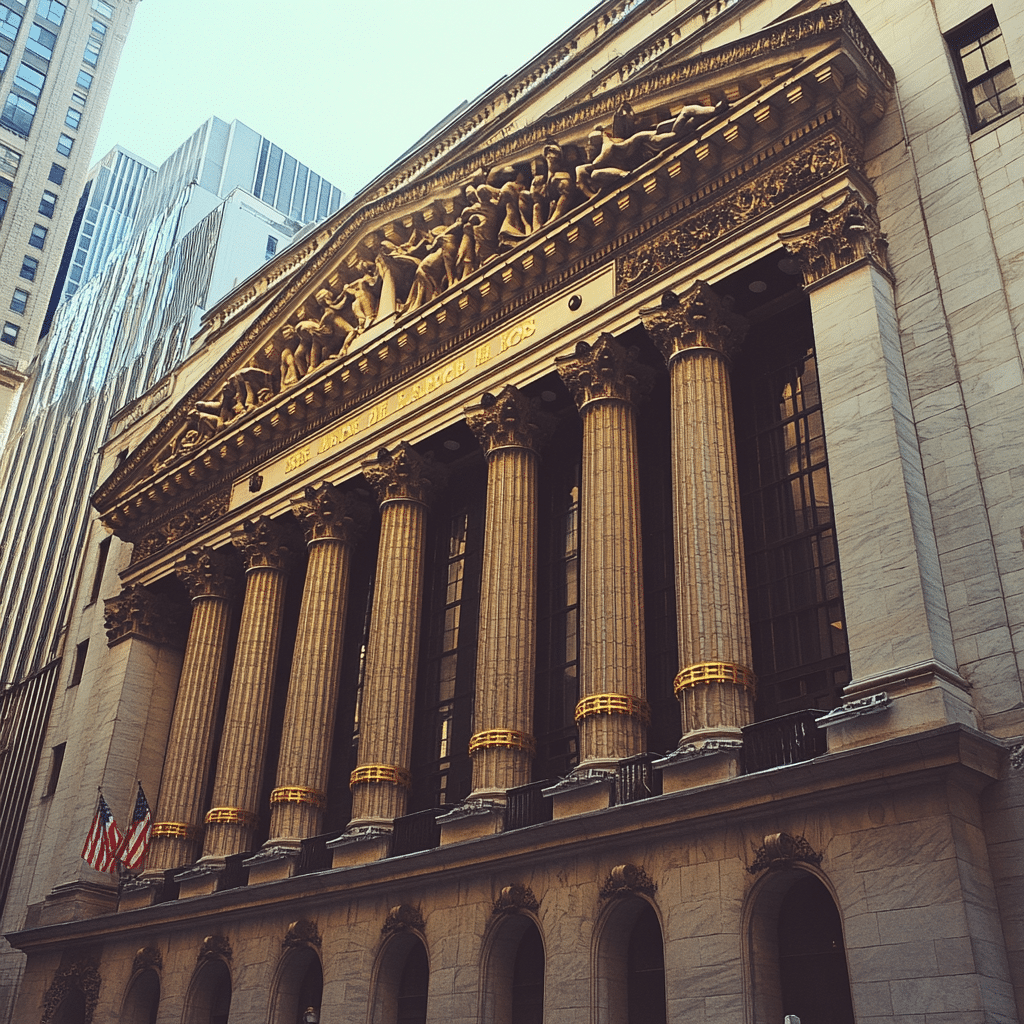

The NYSE Save framework has emerged as an essential strategy for investors looking to navigate the stock market effectively. In a year marked by economic uncertainty and rapid technological changes, understanding how to leverage the tools offered by the New York Stock Exchange (NYSE Save) is critical for achieving your investment goals. With fluctuating markets and diverse global influences, this guide aims to empower you with insights and tools to enhance your investing knowledge and skill set.

The NYSE Save approach not only simplifies the complexities of investing but also helps you stay relevant in a fast-paced environment. As you embark on your investment journey, recognize the importance of adapting your strategies, learning from community experiences, and utilizing various resources to sharpen your trading instincts. Let’s explore some standout tools that can propel you toward stock market success.

Top 7 NYSE Save Tools That Propel Investors toward Success

It’s not just about picking the right stocks; utilizing the right tools can significantly maximize profits and minimize risks. Here are seven indispensable tools to harness the power of the NYSE Save philosophy.

1. TradingView: Advanced Charting Features

TradingView serves as a critical tool for investors by providing advanced charting functionalities that help visualize stock performance in real-time. With its robust features, users can analyze stock metrics across various time frames and apply an array of technical analysis indicators. For instance, Jane Doe, a tech-savvy finance enthusiast, uses TradingView to track tech stocks like Apple and Tesla. By implementing Fibonacci levels and trend analysis, she can make informed decisions during key market transitions.

2. NYSE Market Data APIs: Real-Time Insights

If you’re an algorithmic trader, you’ll find the NYSE Market Data APIs invaluable. These APIs grant access to real-time pricing, trading volume, and market depth, enabling investors to make split-second decisions. For example, a trading application built on this API can send alerts when stock price thresholds are breached, akin to the automated trading systems utilized by firms like Renaissance Technologies. Investors who tap into this resource can significantly enhance their responsiveness to market fluctuations.

3. Oorn Hub: Community Support and Resources

Oorn Hub is an innovative platform that fosters community collaboration and offers a plethora of investment resources, including webinars and discussion forums. By joining Oorn Hub, investors can share insights on successful strategies and learn from seasoned traders. Recent conversations have spotlighted the market’s shifting sentiment toward renewable energy stocks, with companies like NextEra Energy showcasing aggressive growth strategies. Engaging with a community like Oorn Hub keeps you well-informed and connected.

4. NYSE Euronext: Comprehensive Market Analysis

NYSE Euronext offers a detailed outlook of stock indices, providing investors with comprehensive reports and analytics. This resource proves especially valuable when evaluating broader market trends. For example, a comparative analysis during Q2 2024 showed a significant uptick in investments in technology stocks, largely due to rising consumer spending on electronics and digital services. This knowledge can guide beginner investors in making wise asset allocations.

5. Bloomberg Terminal: In-Depth Financial Reporting

Though the Bloomberg Terminal carries a heftier price tag, it remains an essential resource for serious investors. Its in-depth financial reports, real-time trade alerts, and extensive news coverage equip users with timely insights. Investors can track global supply chain disruptions and assess their potential impact on companies like Boeing, allowing for swift reallocation of investments based on breaking news. In today’s rapidly changing environment, access to such data is crucial.

6. Investment Simulators: Practice Before You Play

Investment simulators, like Investopedia’s offerings, allow individuals to practice trading strategies without risking real money. This tool is particularly popular with beginners who want a grasp on market dynamics. For example, a novice can simulate trading strategies with prominent stocks like Amazon and Netflix, analyzing their behaviors before diving into real investments. In doing so, potential pitfalls can be identified before actual financial risks are taken.

7. Financial Podcasts: Learning from the Experts

Tuning into financial podcasts, such as “Invest Like the Best” or “The Rich Dad Show,” brings invaluable insights from market experts. These platforms frequently feature interviews with successful investors, like Warren Buffett, who unveil their strategies and philosophies. Engaging with this content offers fresh perspectives, arming you with strategies to tackle the fast-paced trading environment effectively.

Navigating the Future: Adapting Your Investment Strategy

The stock market landscape continuously evolves, influenced by technological advancements and shifting social dynamics that alter investor behavior. Adapting your strategy requires grasping the tools at your disposal, along with understanding the market mechanics. The NYSE Save approach, coupled with resources from platforms like Oorn Hub, sets a solid foundation for empowering investors.

As 2024 unfolds, staying updated on emerging trends and engaging with community resources becomes paramount. Maintaining flexibility in your investment strategy will allow you to respond adeptly to changes, whether they be global crises or local market shifts. By leveraging the tools mentioned here and committing to continuous education, you enhance your chances of achieving stock market success in the volatile months ahead. Embrace this transformative investment journey, and watch as your acumen flourishes within the NYSE environment.

Investing isn’t just about numbers—it’s about making connections, understanding what’s at stake, and demonstrating a dedication to learning and adapting. Whether you’re tracking the Cleveland Guardians’ player stats, assessing market impacts from a Skims sale, or pondering the implications of a default on mortgage options, each decision contributes to your investment narrative. The world of finance may be intricate, but with the right tools and a community behind you, success becomes an attainable reality.

Discovering nyse save: Fun Facts and Trivia

Unveiling the nyse save Journey

Did you know that navigating the stock market is a lot like a high-stakes game? Just like in a Cleveland Guardians vs. White Sox match where every player has a vital role, the stock market’s players—investors and analysts—work in concert to achieve success. Understanding strategies like nyse save can make all the difference in your investing journey. Speaking of series, you might want to check out the historical nuances in the Yankees vs. Cleveland Guardians timeline; it’s fascinating how both sports and markets require keen insights and timing for victory!

Tall Tales in Finance and Beyond

Height has always played a role in sports, and just like Yao Ming’s towering stature of over 7 feet, certain stock market principles can stand above the rest. The nyse save initiative helps investors reach new heights in their portfolio performance, and it’s all about building knowledge that lasts. As you mull over investment risks, don’t forget the impact of current events—like the latest player stats in the Cleveland Guardians vs. Minnesota Twins match. It’s amazing how external factors can sway a game’s outcome or the stock prices!

The Lairg of Trading Wisdom

Every investor looks for insights that can guide their trading journey. Much like how audiences flock to the Metrograph for a unique film experience, savvy stock traders are drawn to tools and resources like nyse save to enrich their financial decisions. It’s all about feeling equipped to take on challenges. Just remember, the stock market dances to a different rhythm, and understanding that rhythm can be the difference between winning and losing, echoing the thrill of a well-played game.